Offering discounts to customers is a common way to incentivize prompt payment and build customer loyalty. Discounts can come in various forms such as early payment discounts, volume discounts, or seasonal promotions. To effectively implement these strategies, it is important to clearly indicate them on the invoice. Operating on a subscription pricing model for more than 20 years has given us the opportunity to face and overcome the practical pain points of subscription businesses. An advance payment confirms the client’s commitment and offsets the possible loss to the business if the customer suddenly cancels the project. You can note important account information and mention seasonal promotion details—or you can simply say, “Thank you for your business!

Business contact information

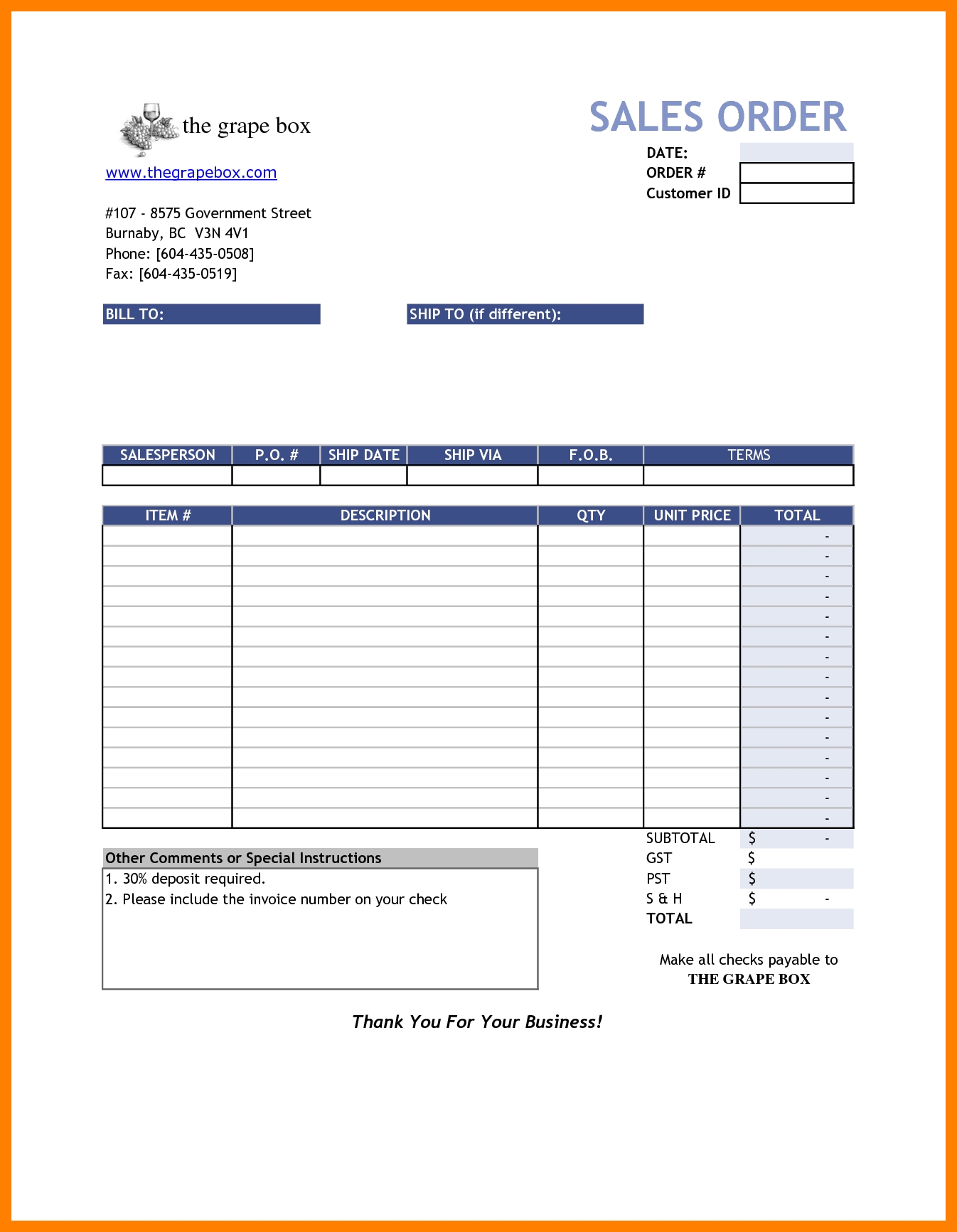

If you own a service-based business, include the title of your project and a description of the services provided. If you’re selling a range of products, include your SKU or product ID in the itemised list on your invoice. For example, business owners may consider using pay-enabled invoices that allow customers to pay their bills directly from the online invoice. You might also consider a customer’s credit history when developing payment terms, particularly for large sales. From there you can decide how long your customer needs to settle an invoice. If you’re a small business, and you don’t send many invoices, you may not be ready for specialized software or a service like FreshBooks.

Date of service rendered

Including this information is standard procedure on all invoices and is especially important for any customers who want to claim back any VAT that has been charged. With QuickBooks, you can easily check which customers have made payments and which customers are yet to pay. By making sure that you are clearly defining your preferred mode of payment, you can avoid any hassles on the part of your customers while making payments. A receipt is a simple, official acknowledgement that an order has been filled and paid for. If you send your client a receipt, you’ll do so after you’ve already sent an invoice and been paid.

What Elements Does An Invoice Include?

Finally, the taxes and fees section should include any applicable taxes or fees, such as sales tax or shipping fees. It is important to be transparent about these costs to avoid any surprise charges for the client. The description of goods or services is another critical element of an invoice. This section should provide a detailed description of the goods or services provided, including quantities and prices.

Schedule a demo and get your questions answered by our product experts

Interim invoices are sent periodically through a project, typically in alignment with pre-agreed-upon milestones. Companies may opt to send a month-end statement as the invoice for all outstanding transactions. If this is the case, the statement must indicate that no subsequent invoices will be sent. Historically, invoices have why you should get a cpa to prepare your taxes been recorded on paper, often with multiple copies generated, so the buyer and seller each have a transaction record. You should also consider a customer’s credit history when developing payment terms, particularly for large sales. Businesses can use invoices to track what customers owe in total as a way to monitor cash flow.

- Invoicing software ensures that payments are absolutely secure with PCI DSS compliance.

- By properly recording invoices and payments, companies can ensure that their financial records are accurate and up-to-date.

- While both invoices and receipts are records of transactions, an invoice is a request for payment and indicates the outstanding amount due.

- The cost and complexity of a project may factor into the payment terms you choose.

- Choose invoicing terms that encourage early payment to maximise your cash position and your likelihood of getting paid.

You want to choose software that is easy to navigate and use, so that you can quickly create and send invoices without any hassle. The invoice should also include a detailed description of the goods or services provided, along with their individual prices and any applicable taxes. When you’re ready, turn your estimate into an invoice with a click. Set up custom payment schedules to streamline the way you receive your money. Both invoices and bills are records of a sale that indicate how much a customer owes a seller. Both are issued before a customer has paid for a transaction, but there are some differences between each term.

Sit back and let your software take care of your invoices by automating tedious recurring tasks from invoicing workflows to payment reminders. Recurring invoices are created and sent to customers at regular intervals, for repeating transactions like subscription fees. The invention of computers brought about the next big change in invoicing.

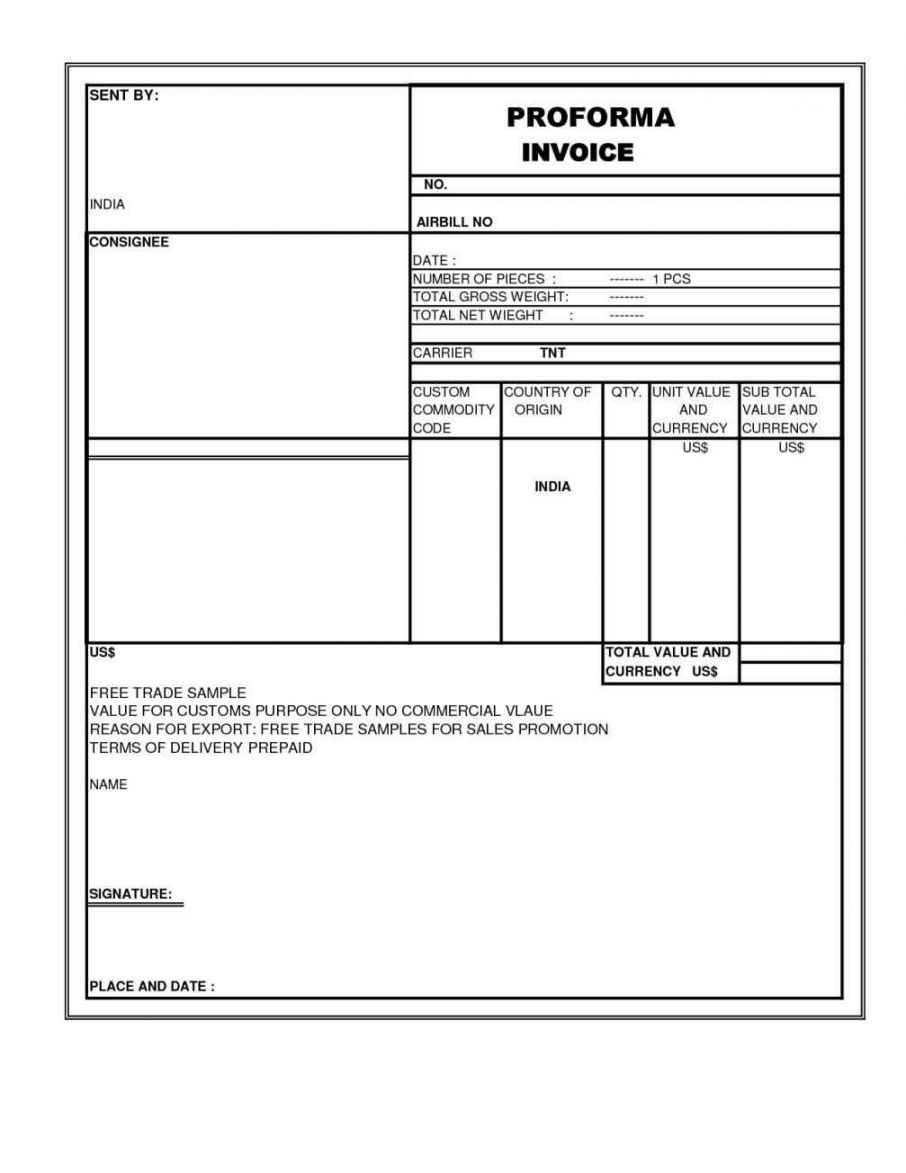

Commercial invoices act as customs declarations and are mainly used to identify the contents of delivery and the two relevant business parties. Invoices are the backbone of the accounting system for small businesses. An invoice tells your client how much they owe you, when the payment is due, and what services you provide.

In that case, you can quickly create invoices online using free templates and generators. Here are a few of the simplest and most effective, organized by format. Commercial invoices are customs documents used when a person or business is exporting goods internationally. The information included in commercial invoices is used to calculate tariffs. Interim invoices are issued when a large project is billed across multiple payments. Businesses use interim invoices to collect progress payments before a project is completed.