You can evaluate your accounts receivable and temporary accounts payable, payroll, inventory, and tax filings, clean up your chart of accounts, and back up your data by following these procedures. Sort through invoices, credit card statements, receipts, bank statements, and other necessary financial data. At this point, you should identify any missing information and reach out to your clients for clarification or additional documentation. It’s similar to reconciling your bank accounts to reconcile your credit card balances. It requires verifying that all transactions are appropriately recorded by comparing your credit card statements to your accounting software. Comparing your bank statements to your accounting software to ensure all transactions are appropriately recorded is reconciling your bank accounts.

Ensure your balance sheet balances

Karbon’s Template Library has over 250 accounting and bookkeeping workflow templates for you to use and customize to suit your firm. You can add them to your Karbon account with one click or you can download them as Microsoft Excel files. In this article, you’ll find a best practice bookkeeping checklist template, plus a checklist for emergency bookkeeping cleanup projects.

Reconcile credit card statements

The next step in your bookkeeping cleanup checklist is to reconcile your bank statements. Take a look at your bank statements over the course of the timeframe you are working on. Make a note of any discrepancies, like a missing check or deposit. Once you’ve reviewed, paid, and recorded both customer and vendor invoice payments, you are ready to check your credit card accounts and bank statements for accuracy. To sum up, a bookkeeping cleanup checklist is vital for ensuring that your financial records are correct and current.

- This step is crucial to getting accurate information for your financial reports.

- So once you catch up on your books, continue to reconcile your bank statements each month.

- This signifies no unadjusted entries were made in prior years, simplifying tax filing.

- And for your staff performing bookkeeping, consistency is another goal that can be hard to reach.

Consider investing in solopreneur accounting software to level up. A big part of not letting anything slip through the cracks is updating your bookkeeping software. It can only help you as much as you keep it updated with all possible aspects of your monthly finances. A solution like Jetpack Workflow will generate more accurate reports with more useful information.

You can use this bookkeeping cleanup checklist to help you stay on track. The good news how to set up payroll for your small business in 9 steps is the more consistently you do this, the less time it will take. If your greatest discovery during this process is that you don’t have the time, energy, or knowledge to do this on your own, it’s time to outsource your bookkeeping.

#5: Reconcile Credit Card and Bank Accounts

Financial institutions allow access to bank feeds which allow you to import most transactions directly. Our 12-step guide and downloadable checklist transform the bookkeeping cleanup process from a daunting task into a manageable system for solopreneurs and small business owners alike. If you’re new to bookkeeping checklists, this is a great place to start your journey towards being more efficient. If you already have a checklist going, then you’ll surely find some gems to add to it below.

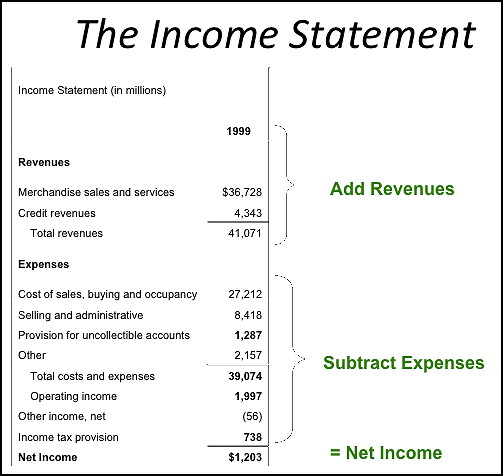

You can use this report to examples of the cash and accrual method find out how profitable your business is and determine the cost of running your business. This report also allows you to forecast your sales and expenses for the next fiscal year. By auditing your receivables, you can ensure that all unpaid bills are appropriately recorded and that you follow up with clients/customers who still need to pay. Depending on your bookkeeping software, you may be able to automatically categorize transactions as they occur, which helps keep your bookkeeping updated. An accounting professional can help you unravel and clean up accounting records. To learn more about how these and other Karbon features can help automate aspects of the bookkeeping cleanup process, book a demo or start a free trial.

Waiting for clients to send you the right information and documentation can be a massive time sink with a lot of back-and-forths. Increase efficiency with this best practice bookkeeping workflow process for month-end close. Lessons learned on how top firms grow fast, build stronger teams, and increase profit while working less. Though the free template will work, teams should look at automated workflow management software to make the process more efficient. The cost of bookkeeping cleanup varies depending on the scope of the project and the experience level of the bookkeeper you hire.